[Updated March 9th, 2022] On March 9th, 2022 the Information Commissioner published the final report regarding this matter on it’s website. Read the final report using this link. Below is the official message as well from the Office of the Information Commissioner.

GCMS notes is a report from the Global Case Management System and this report can be obtained from IRCC or CBSA. Both IRCC and CBSA are working towards developing a new condensed format of the GCMS notes. CBSA rolled out the new format in the summer of 2021. IRCC is expected to officially launch the new format in the near future.

In the old or the legacy format of the GCMS notes the “History” section of the GCMS notes has been withheld or redacted by IRCC since around October of 2020. CBSA on the other hand does not withhold it in the old format of the GCMS notes. Note : The ‘History” section is not provided in the new format of the GCMS report.

This phenomenon of withholding the “History” section started with IRCC around October 2020 when it began stating that information could not be generated because of a system glitch. See the below email correspondence with IRCC about this topic. Prior to October 2020 IRCC did not withhold the “History” section in its entirety like it does now.

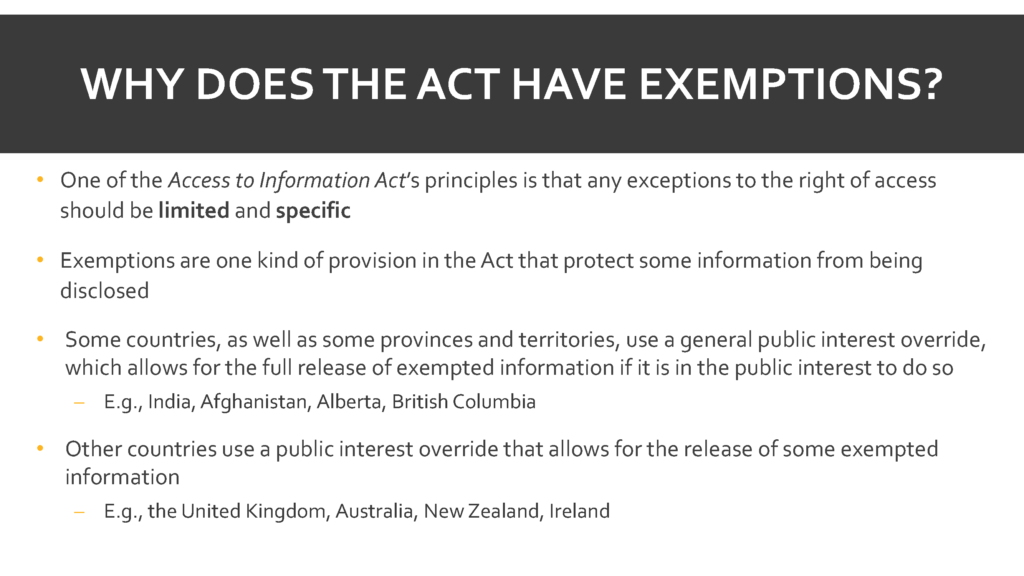

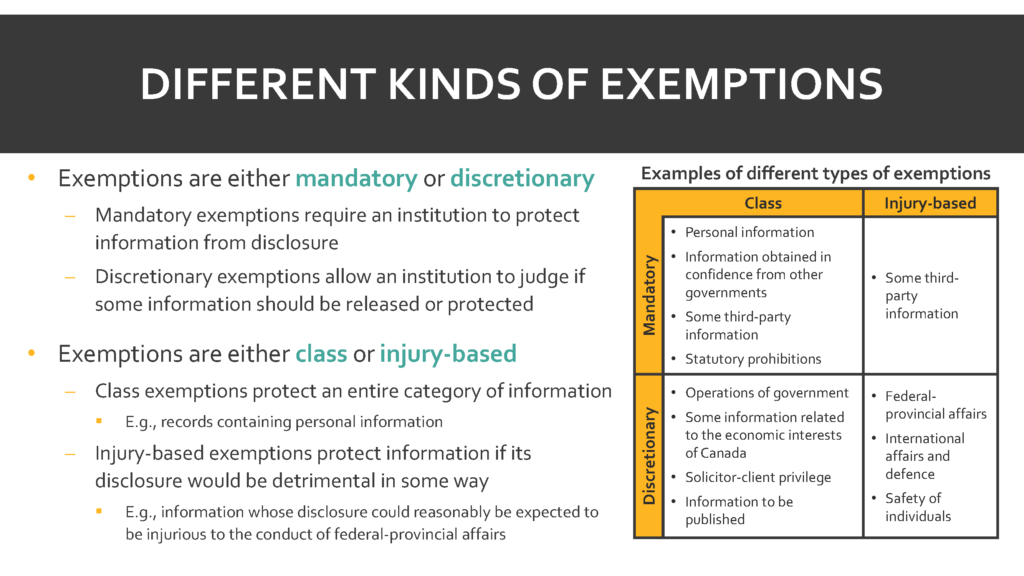

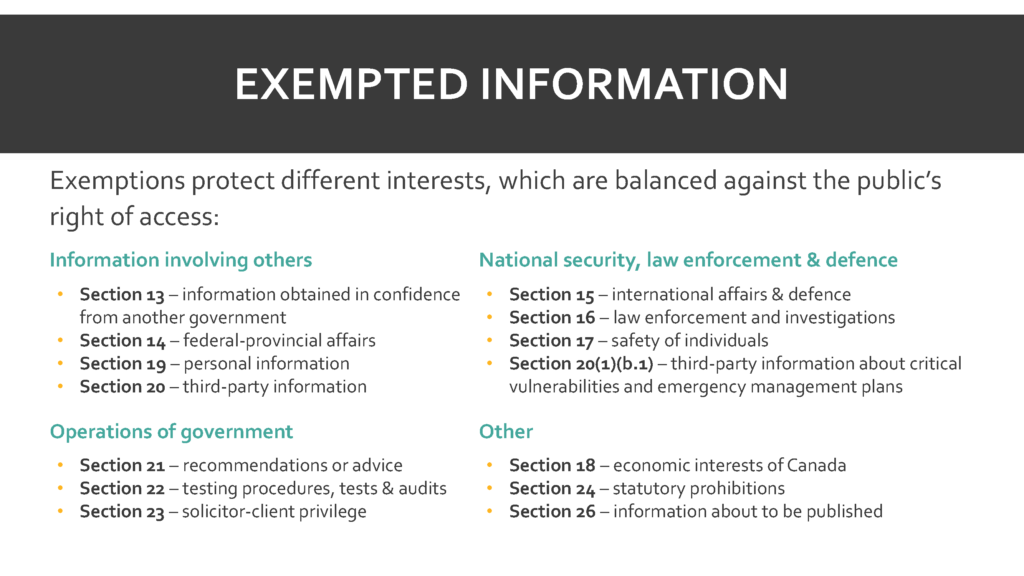

Overview of exemptions

Information can be withheld from the GCMS notes, it’s quite normal and below is a quick overview of Exemptions. Source of this information is the Treasury Board of Canada Secretariat

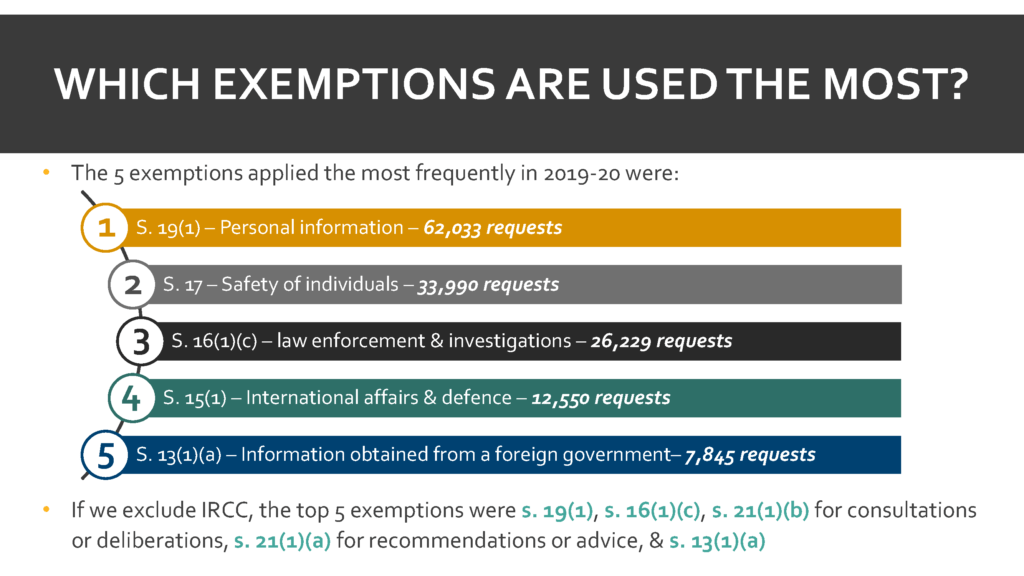

Statistics on the use of 16(2)(c)

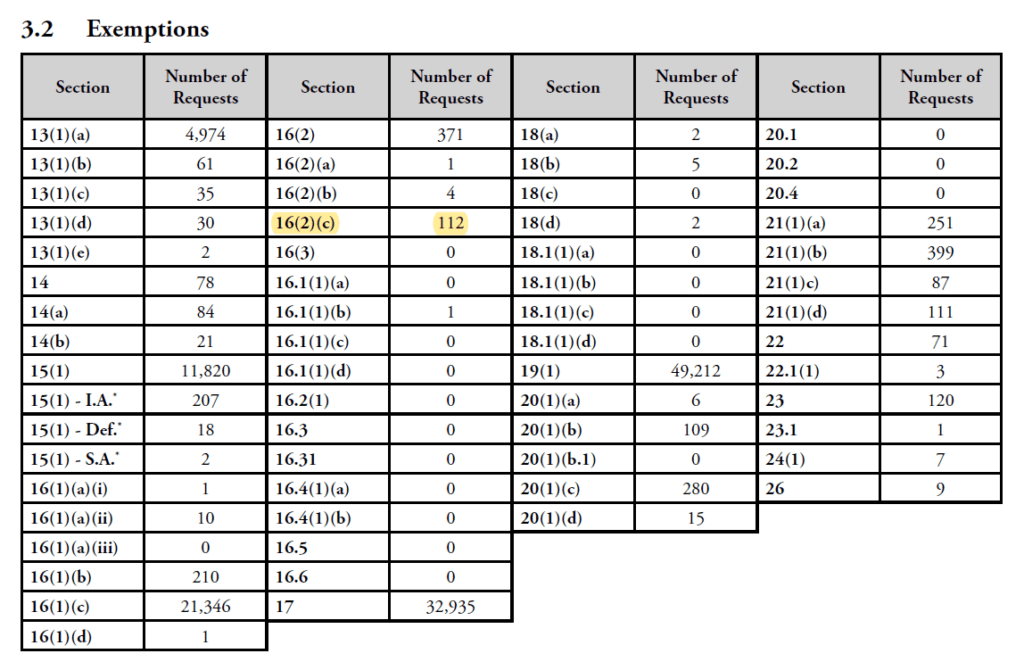

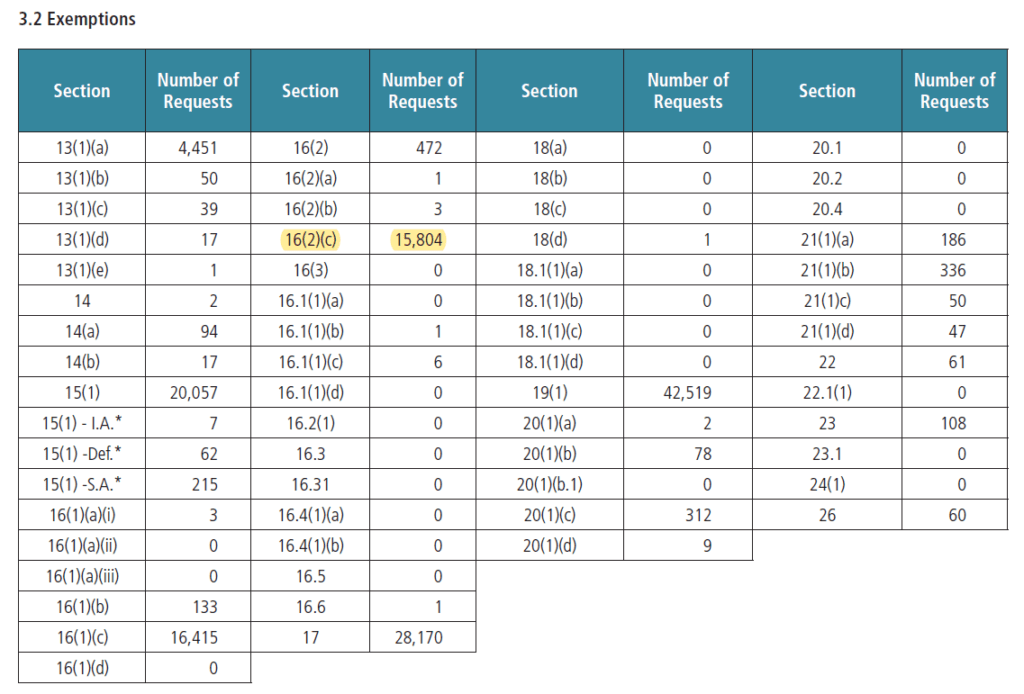

Section 16(2)(c) is the exemption used by IRCC to withhold the “History” section since around the start of 2021. In it’s annual report ending March 2020 IRCC provided statistics as to how many times it used section 16(2)(c) – it was used only 112 times. The annual report for the period ending March 2021 was released on December 13th, 2021 and as expected the statistics are significantly higher.

16(2)(c) was invoked only 112 times out of 116,928 requests

16(2)(c) was invoked only 15,804 times out of 104,547 requests

What to make of the missing pages in GCMS?

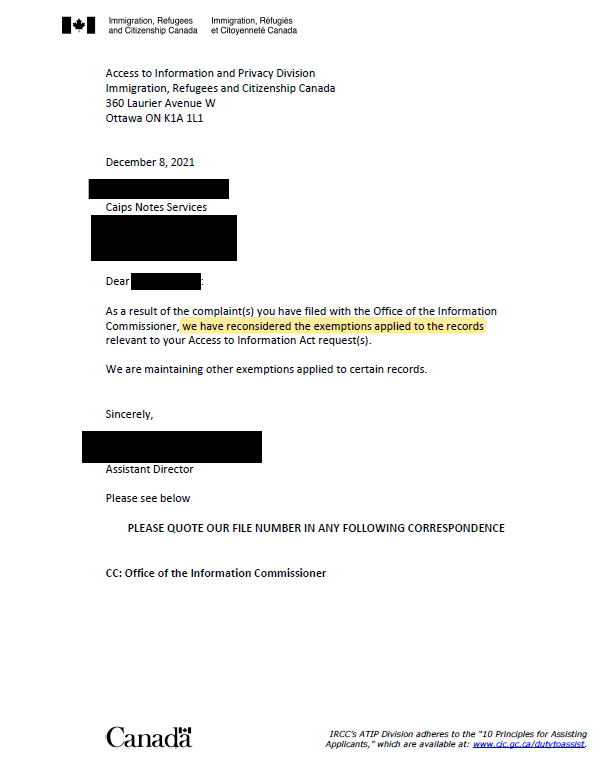

IRCC can withhold information citing the exemption used, it’s permitted under the Act if used for valid reasons. We are challenging the validity of the use of this exemption by IRCC. The issue is being looked at by the Office of Information Commissioner of Canada (OIC). We will update this section with OIC’s decision, whatever the decision may be.

[Update: December 9th, 2021] The decision from OIC is anticipated soon and it is expected to show that our complaint against IRCC is well founded, see below.

What can be done in the meantime?

If the “History” section of the GCMS notes is important for you to review then you can request the old format of the GCMS from CBSA. As of this writing CBSA is not withholding the “History” section in the manner IRCC is.